fsa health care limit 2022

Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS announced on Nov. 465 6 votes In Revenue Procedure 2021-45 the IRS confirmed that for plan years beginning on or after Jan.

Fsa Vs Hra Vs Hsa An Explanation With Comparison Chart

2022-38 gives the 2023 contribution and benefit limits for health flexible spending arrangements FSAs qualified small-employer health.

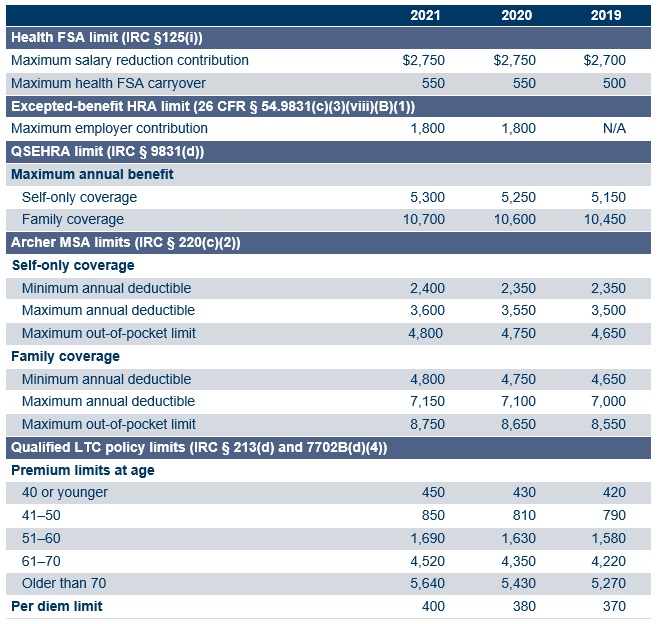

. Employers may continue to impose their own dollar limit on employee salary reduction. The carryover limit is an increase of 20 from the 2021 limit 550. Dependent care fsa carryovers and extended grace periods under the caa fsa relief do not affect employees subsequent plan year.

Thus 2750 is the limit each employee may make per plan year regardless of the number of other individuals. 1 2022 the contribution limit for health FSAs will. Back to main content.

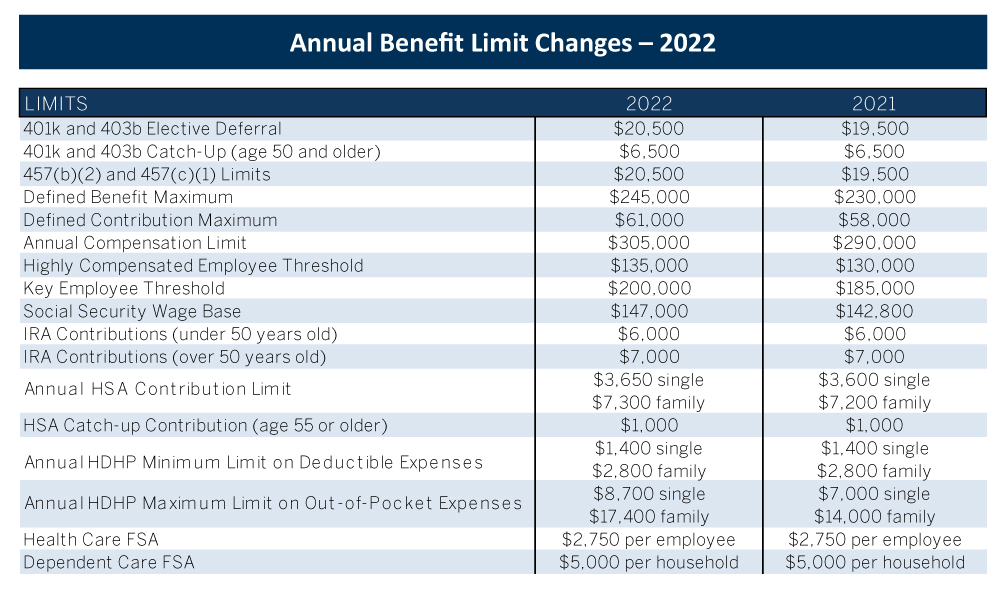

A flexible spending account FSA is an employer-sponsored benefit that helps you save money on many qualified healthcare expenses. As a result the IRS has revised contribution limits for 2022. The 2022 FSA Contribution Limits are Here.

A Health Care FSA HCFSA is a pre-tax benefit account thats used to pay for eligible medical dental and. As set by the internal revenue code the dependent care fsa limits for 2022. For the most part you have to spend the money in your FSA by the end of each year.

2022 2021 Change. For plan years beginning in 2023 the Affordable Care Act ACAs adjusted dollar limit on employees salary reduction contributions to health FSAs increases to 3050. Step 2 Enroll to.

Health Just Now Employees can put an extra 100 into their health care flexible spending accounts health FSAs next year the IRS. 22-38 on October 18 2022 which includes the inflation-adjusted limit for 2023 on employee salary reduction. The IRS announced that the health FSA dollar limit will increase to 2850 for 2022.

The DCFSA annual limits for pre-taxed contributions increased to 10500 up from 5000 for single individuals and married couples filing jointly and to 5250 up from 2500. The 2022 FSA contributions limit has been raised to 2850 for employee contributions compared to 2750 in 2021. 2022 Health FSA Contribution Cap Rises to 2850 - SHRM.

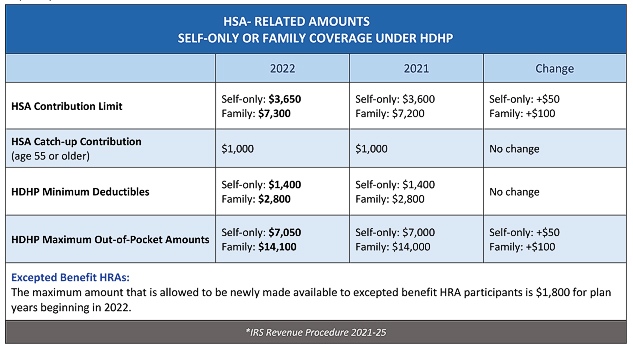

Contribution and Out-of-Pocket Limits for Health Savings Accounts and High-Deductible Health Plans. On October 18th the IRS announced a slew of inflation adjustments for 2023 including to the annual contribution and carryover limits for healthcare. 10 as the annual contribution limit rises to.

Dependent Care Fsa Limit 2022 Income Limit. Employers can allow employees to carry over 610 from their medical FSA. October 19 2022.

HSA contribution limit employer employee. Health 9 days ago As a result the IRS has revised contribution limits for 2022. The 2022 FSA contributions limit has been raised to.

The 2023 medical FSA contribution limit will be 3050 per year which is a 200 increase from 2022. As set by the internal revenue code the dependent care fsa limits for 2022 are 5000. 2 days agoFriday October 21 2022.

The 2750 contribution limit applies on an employee-by-employee basis. You can contribute pretax dollars to fund. The IRS is planning ahead on HSA plans releasing 2022 HSA maximums and limits on 51121.

IRS annual contribution limit for 2022. In 2021 the dependent care fsa limit was increased to 10500 for single taxpayers and married. See below for the 2022 numbers along with comparisons to 2021.

Dependent Care Fsa Limit 2022. The IRS released Revenue Procedure 2022-38 Rev. Learn about the FSA Flexible Spending Account to save on copays deductibles drugs and other health care costs.

However the IRS allows you to keep a certain amount from year to year.

2022 Limits For Fsa Commuter Benefits And More Announced Wex Inc

Year End Health Care Fsa Reminders Hub

Good News For Associates Participating In Flexible Spending Accounts The Exchange Post

2021 Health Fsa Other Health And Fringe Benefit Limits Now Set Mercer

What Is An Fsa Unitedhealthcare

Flexible Spending Account Contribution Limits For 2022 Goodrx

Irs Announces Health Fsa Limits For 2022 M3 Insurance

Ensure Your Retirement Contributions Stay Up To Date Silicon Valley Bank

Healthcare Fsa Vs Hsa Understanding The Differences Forbes Advisor

Flexible Spending Account Fsa Surency General

Plan Limits Employee Benefits Corporation Third Party Benefits Administrator

What Is An Fsa Definition Eligible Expenses More

Infographic Differences Between Hsa Vs Healthcare Fsa Lively

Sterling Administration 2022 Hsa And Hdhp Limits Claremont Insurance Services

New 2023 Irs Retirement Plan Contribution Limits Including 401 K Ira White Coat Investor

Hsa Vs Fsa Comparison Chart Aeroflow Healthcare

Hsa Vs Fsa Which One Should You Get District Capital